Have you ever wondered what separates the financially successful from everyone else? Why some people seem to build wealth effortlessly, while others struggle to make ends meet? The truth is, wealth creation isn’t about luck—it’s about understanding the principles that guide smart investments, financial planning, and asset management.

In a world full of economic uncertainties, knowing how to navigate challenges like crises and inflation can unlock opportunities to grow your wealth. Whether it’s leveraging the power of compound interest, diversifying your income streams, or adopting the Pareto Principle to maximize efficiency, these timeless strategies can transform your financial future.

But here’s the good news: you don’t need to be a financial expert to start. This guide will walk you through the secrets used by the world’s wealthiest individuals, offering practical tips to take control of your financial success. Are you ready to take the first step toward building wealth and creating a future you deserve? Let’s dive in!

Key Takeaways

- Investing during crises can unlock unique opportunities to acquire undervalued assets and build long-term wealth.

- Saving alone isn’t enough; investing in assets with high growth potential is essential for financial success.

- Wealthy individuals focus on buying income-generating assets while avoiding liabilities that drain their finances.

- Compound interest, often called the “eighth wonder of the world,” accelerates wealth creation over time.

- Diversifying your portfolio across assets, sectors, and regions minimizes risks and boosts financial security.

- Relying solely on trading time for money limits earning potential; building multiple income streams is key.

- Leveraging technology can improve productivity, automate finances, and open doors to new opportunities.

- Establishing strict financial principles, like budgeting and avoiding unnecessary debt, ensures consistent growth.

- The Pareto Principle (80/20 rule) helps focus efforts on the actions that drive the most significant results.

- Achieving financial success is a journey of discipline, strategy, and consistent small steps toward long-term goals.

Investing During Crises is the Path to Opportunities

When economic storms hit, most people retreat, holding tightly to their savings. But did you know that some of the wealthiest individuals in history made their fortunes during turbulent times? Investing during crises may feel counterintuitive, but it’s often the gateway to extraordinary financial opportunities.

Think about it: when markets are down and assets are undervalued, it’s like a massive sale in the financial world. Would you turn away from a golden opportunity to buy quality investments at a discount?

Here’s why investing during crises can be a game-changer:

1. Undervalued Assets Await

During economic downturns, many assets, from stocks to real estate, are sold at prices far below their true value.

- Example: Properties in prime locations may suddenly become affordable due to panic selling.

- Smart investors recognize this as the perfect chance to acquire high-value assets for less.

2. The Power of Patience

Crises don’t last forever, and markets tend to recover—and often, they come back stronger.

- History shows that investments made during recessions frequently yield higher returns once the economy rebounds.

- As Warren Buffett says, “Be fearful when others are greedy, and greedy when others are fearful.”

3. Emotional Control is Key

Investing during a crisis isn’t just about numbers; it’s also about maintaining a clear head.

- Avoid panic and focus on long-term potential rather than short-term losses.

- Build a strategy that aligns with your goals, even when the market feels unstable.

4. Diversification Protects Your Wealth

If you’re hesitant about taking big risks, consider diversifying your investments.

- Mix safer options, like bonds, with higher-risk assets to balance your portfolio.

- This way, you can capitalize on opportunities without putting all your money on the line.

Pro Tips to Get Started

- Educate Yourself: Learn about sectors that thrive during crises, such as healthcare or technology.

- Start Small: You don’t need a fortune to begin investing. Even micro-investments can add up over time.

- Consult an Expert: If you’re unsure, seek advice from financial professionals to guide your decisions.

When others shy away from the market, it’s your moment to shine. By understanding the opportunities hidden within economic crises and acting wisely, you can turn challenges into stepping stones for financial success. Remember, the best opportunities often come when you least expect them—are you ready to seize yours?

Saving Alone Isn’t Enough; Investing is the Road to Wealth

Have you ever wondered why your savings, no matter how carefully accumulated, don’t seem to grow significantly over time? That’s because saving alone isn’t designed to build wealth—it’s merely the first step. The real magic happens when you put your money to work through smart investments.

Saving is safe, yes, but it often doesn’t account for inflation. Think about it: the purchasing power of your money today might not hold the same value ten years down the line. This is where investing steps in to bridge the gap and help you secure financial success.

Why Saving Alone Falls Short

While saving provides a safety net, it doesn’t offer significant growth. Here’s why:

- Low Returns: Savings accounts and fixed deposits offer minimal interest rates, often below inflation levels.

- Missed Opportunities: Money parked in savings lacks the opportunity to multiply through compounding or market growth.

- Inflation Impact: Over time, inflation erodes the value of stagnant money.

The Case for Investing

Investing is how your money works for you, and here’s why it’s essential:

- Higher Returns: Stocks, bonds, mutual funds, and other investment vehicles typically yield better returns than savings accounts.

- Compound Interest: By reinvesting earnings, you can benefit from exponential growth over time.

- Wealth Creation: Investments help you accumulate assets, leading to long-term financial stability.

How to Transition from Saving to Investing

- Set Clear Goals: What are you investing for? Whether it’s retirement, a home, or financial freedom, define your objectives.

- Start Small: You don’t need a large sum to begin. Micro-investments or apps make it easy to start with as little as $10.

- Diversify: Spread your investments across different asset classes to reduce risk.

Popular Investment Options

- Stocks: Great for long-term growth if you’re willing to take moderate risks.

- Real Estate: A tangible asset that often appreciates over time.

- Mutual Funds or ETFs: Managed funds that diversify your money across various investments.

- Bonds: Lower-risk options that offer steady, predictable returns.

Pro Tips to Maximize Your Investments

- Educate Yourself: Knowledge is power. Read about market trends, attend seminars, or listen to podcasts.

- Stay Consistent: Regularly contribute to your investments, even in small amounts.

- Be Patient: Wealth creation takes time; avoid impulsive decisions based on market fluctuations.

When it comes to financial growth, the equation is simple: saving is a good habit, but investing is a game-changer. By shifting your mindset and putting your money to work, you can unlock doors to wealth creation and secure the future you’ve always envisioned. So, are you ready to let your money grow beyond the boundaries of a savings account? The journey starts today!

The Rich Buy Assets, While the Poor Buy Liabilities

Have you ever stopped to think about where your money truly goes? One of the biggest distinctions between the wealthy and everyone else lies in what they choose to buy. While the poor often spend on things that drain their finances, the rich focus on acquiring assets—things that grow in value and generate income.

If you’re serious about building wealth, understanding this difference is crucial. Let’s dive into why the rich invest in assets and how you can adopt the same mindset.

What Are Assets and Liabilities?

- Assets: These are things that put money in your pocket. Examples include stocks, rental properties, or a business that generates income.

- Liabilities: These are expenses that take money out of your pocket. Think of loans, credit card debt, or a flashy car that depreciates in value.

By focusing on buying assets, you’re essentially setting up streams of income that work for you, rather than working for your money.

How the Wealthy Approach Their Purchases

- Prioritize Investments Over Luxuries

- Instead of splurging on the latest gadgets or cars, the wealthy channel their funds into investments like real estate or index funds.

- They focus on building a portfolio of income-generating assets before indulging in discretionary spending.

- Leverage Passive Income Opportunities

- Passive income sources, such as dividend-paying stocks or rental properties, are top priorities for the rich.

- These assets grow over time and provide financial security, even during economic downturns.

- Understand the Cost of Liabilities

- While liabilities may offer temporary satisfaction, they often lead to long-term financial strain.

- The rich minimize unnecessary liabilities and ensure their assets far outweigh their expenses.

How You Can Start Buying Assets

- Track Your Spending: Begin by analyzing your monthly expenses. Are you spending more on liabilities than on things that grow your wealth?

- Start Small: If you’re new to investing, consider buying fractional shares of stock or using micro-investment apps.

- Reinvest Earnings: Any income generated by your assets should be reinvested to compound your wealth over time.

Asset Ideas to Explore

- Stocks and Bonds: Accessible options for beginners and seasoned investors alike.

- Real Estate: Properties that generate rental income or appreciate in value.

- Business Ventures: Starting or investing in small businesses that can yield high returns.

- Intellectual Property: Earning from creative works like books, patents, or digital products.

Pro Tips for Shifting Your Mindset

- Think Long-Term: Focus on building a solid financial foundation rather than chasing instant gratification.

- Stay Disciplined: Resist the urge to spend on liabilities and redirect those funds toward growing your asset base.

- Learn Continuously: The more you understand about asset management, the better decisions you’ll make.

By choosing to invest in assets rather than liabilities, you’re taking a powerful step toward financial independence. Every dollar you direct toward an asset today is a seed for future growth. So, what’s stopping you? Begin your journey by asking yourself this simple question: Is this purchase going to make me richer—or poorer? The answer could change your financial life.

Compound Interest is the Eighth Wonder of the World

Have you ever dreamed of watching your money grow effortlessly, like magic? That’s the power of compound interest—often called the “eighth wonder of the world” for a reason. It’s not just a financial concept; it’s the secret weapon behind the wealth of some of the world’s richest individuals.

If you’re not leveraging compound interest yet, you’re missing out on one of the most powerful tools for wealth creation. But don’t worry—it’s never too late to start. Let’s break it down and see how you can harness its potential.

What is Compound Interest?

In simple terms, compound interest is when the money you earn from your investments starts earning money of its own.

- Unlike simple interest, which is calculated only on your initial investment, compound interest builds on both your principal and the interest it generates.

- The longer your money compounds, the faster it grows—this is what makes it so powerful.

Why Does Compound Interest Matter?

- Exponential Growth

- With compound interest, your returns grow at an accelerating rate.

- For example, a $1,000 investment with a 10% annual return can grow to over $17,000 in 30 years if left untouched.

- Time is Your Best Ally

- The earlier you start, the greater your gains will be.

- Even small, consistent investments can snowball into substantial wealth over time.

- Minimal Effort, Maximum Reward

- Compound interest doesn’t require you to constantly manage your investments.

- It works quietly in the background, turning your initial efforts into long-term rewards.

How to Take Advantage of Compound Interest

- Start Early

- Even if you can only contribute small amounts, starting young gives your money more time to grow.

- A 25-year-old who invests $100 a month at a 7% annual return will have significantly more than a 35-year-old who starts investing double that amount.

- Reinvest Your Earnings

- Always reinvest dividends, interest, or any returns you earn.

- This allows your earnings to compound alongside your original investment.

- Stay Consistent

- Contribute regularly, whether it’s monthly, quarterly, or annually.

- Automating your investments ensures you stay on track, no matter what.

Where to Apply Compound Interest

- Retirement Accounts: 401(k)s, IRAs, or similar plans offer long-term growth with compounding.

- Dividend-Paying Stocks: Reinvest dividends to accelerate your earnings.

- Mutual Funds and ETFs: Diversified options that often benefit from compounding over time.

- High-Interest Savings Accounts: A safer option for those hesitant about market volatility.

Common Mistakes to Avoid

- Starting Too Late

- The longer you wait, the less time your investments have to grow.

- Withdrawing Earnings Too Early

- Let your returns stay invested to maximize compounding.

- Ignoring Fees

- High fees can eat into your compounding gains, so choose low-cost investment options.

Harnessing the power of compound interest is like planting a tree: the sooner you plant it, the bigger and stronger it will grow. Whether you’re saving for retirement, a dream home, or financial freedom, this principle can transform your financial journey. So, what’s stopping you? Start today, and let the eighth wonder of the world work its magic for you!

Never Put All Your Money in One Basket

How often do we hear the phrase, “Don’t put all your eggs in one basket”? It’s a piece of advice that’s just as valuable in finance as it is in life. When it comes to managing your wealth, diversification is the golden rule to protect your hard-earned money. But what does diversification really mean, and how can you use it to your advantage?

Let’s dive into the world of diversification and explore how spreading your investments across various assets can safeguard your financial future.

What is Diversification?

Diversification is the practice of spreading your money across multiple investments to minimize risk.

- Think of it as creating a safety net: if one investment underperforms, others can offset the loss.

- It’s about balance—ensuring your portfolio isn’t overly dependent on any single asset.

Why is Diversification Essential?

- Reduces Risk

- By investing in different asset classes, you protect yourself from market volatility.

- If one sector takes a hit, your other investments can act as a buffer.

- Increases Opportunities for Growth

- Different assets perform well under different economic conditions.

- A diversified portfolio allows you to capture growth across various sectors.

- Offers Peace of Mind

- Knowing your investments are spread out reduces financial stress.

- It’s a strategy that aligns with both short-term and long-term goals.

How to Diversify Your Portfolio

- Invest Across Asset Classes

- Stocks: Offer high growth potential but come with higher risk.

- Bonds: Provide stability and predictable returns.

- Real Estate: A tangible asset that often appreciates over time.

- Commodities: Gold, oil, or agricultural products can hedge against inflation.

- Geographical Diversification

- Don’t limit yourself to domestic markets.

- International investments can provide exposure to different economic cycles and opportunities.

- Sector Diversification

- Spread investments across industries like technology, healthcare, and energy.

- This minimizes the impact of downturns in a single sector.

- Include Alternative Investments

- Cryptocurrencies, peer-to-peer lending, or startups can offer high returns, albeit with higher risks.

- These are excellent options for risk-tolerant investors looking to diversify further.

Common Diversification Mistakes

- Overdiversification

- Spreading yourself too thin across too many assets can dilute returns.

- Focus on quality rather than quantity.

- Ignoring Rebalancing

- Your portfolio needs periodic adjustments to stay aligned with your goals.

- Rebalancing ensures no single asset class becomes disproportionately large.

- Chasing Trends

- Avoid jumping into investments just because they’re popular.

- Stick to your strategy and conduct thorough research.

Pro Tips for Smarter Diversification

- Start Simple: If you’re new to investing, consider ETFs or mutual funds, which offer built-in diversification.

- Know Your Risk Tolerance: Choose assets that align with your comfort level and financial goals.

- Stay Informed: Keep up with market trends but make decisions based on data, not hype.

By diversifying your investments, you’re not just reducing risk—you’re positioning yourself for sustainable wealth creation. Remember, no single investment is guaranteed to succeed, but a well-diversified portfolio can weather the storms of market fluctuations. So, ask yourself: is your financial basket secure enough, or is it time to add a few more eggs in different places? The answer could make all the difference.

You Won’t Get Rich by Trading Only Your Time

Have you ever felt like no matter how many hours you work, true financial freedom still seems out of reach? That’s because trading your time for money has its limits. There are only so many hours in a day, and relying solely on earned income caps your potential for wealth creation.

The world’s wealthiest individuals don’t just work harder—they work smarter. They focus on building passive income streams and scaling their efforts to break free from the constraints of time. Let’s explore why relying solely on your paycheck won’t make you rich and how you can shift your mindset to create lasting financial success.

Why Trading Time for Money Has Limits

- Time is Finite

- You have only 24 hours in a day, and working more hours often leads to burnout.

- No matter how high your hourly rate, you’re limited by the number of hours you can work.

- Income Ceases Without Effort

- If you stop working, your income stops too.

- Illness, family emergencies, or other life events can disrupt your ability to trade time for money.

- Inflation Erodes Value

- Even a high salary may not keep up with inflation, reducing your purchasing power over time.

How the Wealthy Break Free

- Focus on Passive Income

- Wealthy individuals invest in assets that generate money with little to no ongoing effort.

- Examples include rental properties, dividend stocks, or royalties from creative work.

- Build Scalable Systems

- Instead of trading hours for dollars, they create systems—like businesses or digital products—that generate income independently of their time.

- Reinvest Earnings

- Every dollar earned is a tool for generating more wealth.

- By reinvesting profits, they create a snowball effect of growing income.

How You Can Escape the Time-for-Money Trap

- Invest in Income-Generating Assets

- Explore investments like real estate, stocks, or mutual funds that work for you even when you’re asleep.

- Develop Passive Income Streams

- Write an eBook, create an online course, or start a blog with monetization options.

- Use platforms like YouTube or Patreon to generate recurring income from your passion.

- Leverage Technology

- Automate tasks and use tools that scale your efforts, such as eCommerce platforms or marketing software.

- Collaborate and Delegate

- Build a team to help you grow your ventures, freeing you to focus on higher-value activities.

Real-Life Examples of Breaking Free

- Investors: Earn consistent income through dividends and real estate rentals.

- Creators: Generate royalties from books, music, or art.

- Entrepreneurs: Scale businesses by outsourcing operations and leveraging online tools.

Pro Tips to Start Today

- Audit Your Skills: Identify talents or expertise that could generate passive income.

- Start Small: Even small investments in stocks or micro-businesses can grow over time.

- Be Patient: Building scalable income streams takes time and effort, but the rewards are worth it.

Shifting your focus from trading time for money to creating multiple income streams is a game-changer for your financial future. By adopting strategies that work for you instead of you working for them, you’ll unlock new opportunities for growth and freedom. Ask yourself: Are you ready to stop clocking in and start cashing in? The journey begins with a single step—take it today!

Create Multiple Income Streams

Do you ever feel like relying on just one source of income is like walking a tightrope without a safety net? You’re not alone. Financial security isn’t just about how much you earn—it’s about how many ways you earn it. The wealthiest people don’t rely on a single paycheck; instead, they build multiple income streams that work together to grow their wealth and protect against financial uncertainty.

So, how can you diversify your income and set yourself on the path to financial success? Let’s break it down.

Why Multiple Income Streams Matter

- Protection Against Job Loss

- If one income stream dries up, others can help you stay afloat.

- Diversification reduces the risks tied to economic downturns or industry shifts.

- Accelerates Wealth Creation

- Additional streams mean more opportunities to invest and grow your wealth.

- Compounded earnings from multiple sources can supercharge your financial goals.

- Supports Long-Term Financial Freedom

- Relying on varied income ensures stability and flexibility in the face of life’s uncertainties.

- It allows you to focus on what you love without financial stress.

Types of Income Streams You Can Build

- Active Income

- Your primary job or freelance work that requires time and effort.

- Great for building initial capital to fund passive income ventures.

- Passive Income

- Earnings from investments or ventures that require minimal ongoing work.

- Examples: rental properties, dividend stocks, royalties, or digital products.

- Portfolio Income

- Profits from investments in stocks, bonds, or mutual funds.

- Offers long-term growth through compounding and reinvestment.

How to Start Building Multiple Income Streams

- Leverage Your Skills and Passion

- Identify skills you can monetize. Are you great at teaching, writing, or crafting?

- Start small with side gigs or freelance opportunities.

- Invest Strategically

- Use your earnings to purchase income-generating assets like real estate or stocks.

- Platforms like REITs or robo-advisors make investing accessible for beginners.

- Create Digital Products

- Consider writing an eBook, launching an online course, or developing a mobile app.

- These ventures offer recurring income with upfront effort.

- Start a Small Business

- Launch a side hustle, such as selling handmade goods or providing consulting services.

- Scale your business over time to become a reliable income source.

- Explore Online Opportunities

- Start a blog, YouTube channel, or podcast that can be monetized through ads, sponsorships, or memberships.

- Use affiliate marketing to earn commissions on product recommendations.

Pro Tips for Managing Multiple Income Streams

- Start with One

- Focus on building one solid stream before adding others. Trying to do too much at once can lead to burnout.

- Automate Where Possible

- Use tools and technology to streamline processes, such as automating investments or scheduling social media posts.

- Reinvest Wisely

- Use income from one stream to fund others, creating a self-sustaining growth loop.

- Track Your Progress

- Monitor the performance of each stream to identify what’s working and where to adjust.

Creating multiple income streams isn’t just about earning more—it’s about gaining control over your financial future. With each new stream, you’re building a foundation of stability and freedom. So, what’s your next step? Whether it’s launching a side hustle or investing in your first dividend stock, the time to start is now. Your future self will thank you.

Leverage Technology to Increase Productivity

Have you ever felt like there just aren’t enough hours in the day to achieve everything you want? Imagine if you could unlock more time, streamline your efforts, and maximize your income—all by harnessing the power of technology. Whether you’re looking to improve your financial success or scale your ventures, using the right tech tools can be a game-changer.

Let’s explore how leveraging technology can boost productivity, simplify your financial management, and open doors to new opportunities.

Why Technology is Essential for Productivity

- Efficiency at Scale

- Automating repetitive tasks frees up your time for high-value activities.

- Tools like accounting software or project management apps can handle the nitty-gritty while you focus on strategy.

- Improved Decision-Making

- Technology provides access to real-time data and insights.

- From investment tracking apps to budgeting platforms, these tools empower smarter financial choices.

- Access to Global Opportunities

- With the internet, you can expand your reach and tap into global markets.

- Whether it’s eCommerce, freelancing, or digital marketing, technology breaks down barriers.

How to Leverage Technology for Financial Growth

- Automate Your Finances

- Use apps to set up automatic bill payments, savings, and investments.

- Robo-advisors can manage your portfolio, optimizing for growth and risk.

- Track and Budget Like a Pro

- Apps like Mint or YNAB (You Need a Budget) help you monitor spending and set financial goals.

- AI-powered tools can analyze your habits and suggest areas for improvement.

- Start an Online Business

- Platforms like Shopify, Etsy, or Amazon allow you to launch and scale an eCommerce business.

- Use analytics tools to track customer behavior and optimize your sales strategies.

- Upskill with Online Resources

- Enroll in online courses to learn new skills that can increase your earning potential.

- Platforms like Coursera, Udemy, or Skillshare offer affordable access to high-quality education.

Boosting Productivity in Everyday Tasks

- Task Management Tools

- Apps like Trello, Asana, or Notion help you prioritize and organize tasks.

- Set reminders and deadlines to stay on track.

- Digital Collaboration

- Tools like Slack, Zoom, or Microsoft Teams streamline communication, making remote work more effective.

- File-sharing platforms like Google Drive ensure seamless collaboration.

- Content Creation and Marketing

- Canva simplifies graphic design for social media or presentations.

- Social media scheduling tools like Buffer or Hootsuite keep your content consistent.

Pro Tips for Maximizing Technology’s Impact

- Stay Updated: Technology evolves quickly, so stay informed about the latest tools relevant to your goals.

- Invest in Quality Tools: Don’t hesitate to pay for premium versions of apps that save time or increase efficiency.

- Simplify Your Tech Stack: Use only the tools you need; too many apps can lead to clutter and overwhelm.

Technology isn’t just about convenience—it’s a powerful ally in your journey toward wealth creation and increased productivity. By embracing tools that work for you, you can save time, make smarter decisions, and achieve more with less effort. So, how will you start leveraging technology today? The possibilities are limitless, and the rewards are yours to claim!

Establish Strict Financial Principles

Do you ever feel like your finances are slipping through your fingers, no matter how much you earn? The truth is, achieving financial success isn’t just about earning more—it’s about managing your money wisely and consistently. Establishing strict financial principles provides the foundation for building wealth, creating security, and achieving your long-term goals.

Let’s explore the key financial principles that can help you take control of your money and set yourself up for success.

Why Financial Principles Matter

- Consistency Leads to Growth

- Financial discipline ensures that every dollar you earn is working toward your goals.

- By sticking to principles, you can avoid impulsive decisions that derail your progress.

- Prepares You for Uncertainty

- Life is unpredictable, and having clear financial rules helps you navigate unexpected expenses or downturns.

- Builds Confidence and Control

- When you know exactly where your money is going, you feel empowered and less stressed about your financial future.

Essential Financial Principles to Live By

- Spend Less Than You Earn

- This golden rule is the cornerstone of financial health.

- Create a budget that prioritizes needs over wants and leaves room for savings.

- Pay Yourself First

- Treat your savings as a non-negotiable expense.

- Automate deposits into your savings or investment accounts to build wealth effortlessly.

- Avoid Unnecessary Debt

- Not all debt is bad, but high-interest loans or credit card balances can trap you in a cycle of repayment.

- Focus on paying off debts quickly and avoiding new ones unless they’re for assets like real estate.

- Have an Emergency Fund

- Set aside at least 3–6 months’ worth of living expenses to protect yourself during tough times.

- Keep this fund in a liquid, easily accessible account.

How to Establish and Stick to Your Principles

- Define Your Financial Goals

- Are you saving for retirement, a home, or financial freedom?

- Having clear goals keeps you motivated to stick to your principles.

- Track Your Progress

- Use apps or spreadsheets to monitor your spending, savings, and investments.

- Regularly review your financial health and adjust as needed.

- Set Rules for Every Dollar

- Follow the 50/30/20 rule:

- 50% of income for needs (housing, food, utilities).

- 30% for wants (entertainment, dining out).

- 20% for savings and debt repayment.

- Follow the 50/30/20 rule:

- Practice Self-Discipline

- It’s tempting to splurge, but remind yourself of the bigger picture.

- Delay gratification by setting milestones and rewarding yourself only after achieving them.

Pro Tips for Strengthening Your Financial Discipline

- Automate Your Finances: Set up auto-pay for bills and investments to remove the temptation of spending first.

- Surround Yourself with Like-Minded People: Being around financially disciplined individuals keeps you inspired and accountable.

- Educate Yourself: Knowledge is power. Read books, attend seminars, or follow financial experts to refine your strategy.

Adopting strict financial principles might feel challenging at first, but the rewards are life-changing. By staying disciplined, you’re not just managing your money—you’re shaping your future. So, ask yourself: What financial rules will you commit to today? Your journey toward wealth begins with the principles you set and the actions you take right now.

The Pareto Principle (80/20): Work Smarter, Not Harder

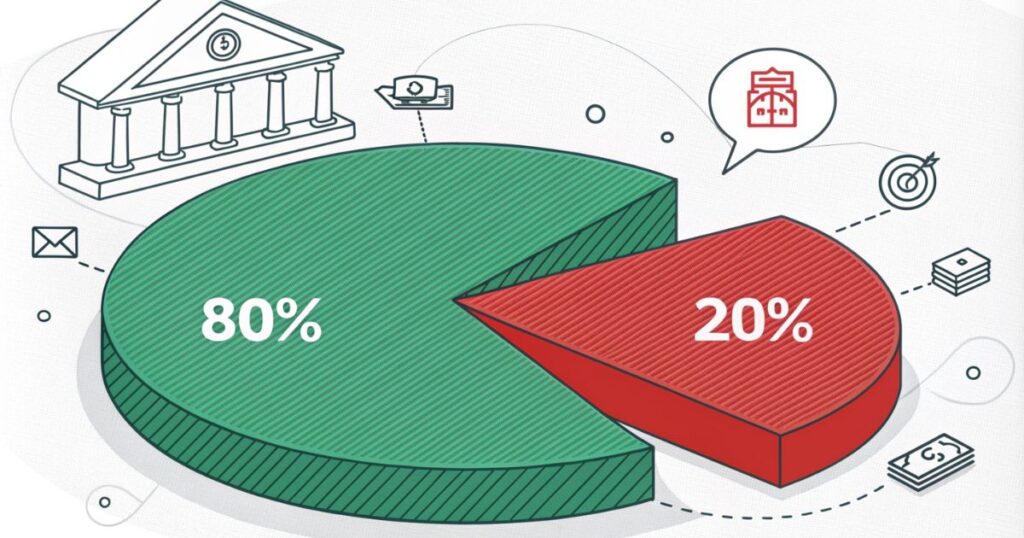

Have you ever felt like you’re working tirelessly but not seeing the results you want? The Pareto Principle, also known as the 80/20 rule, might be the key to unlocking your true potential. This principle states that roughly 80% of your results come from just 20% of your efforts. By identifying and focusing on what truly matters, you can achieve more with less stress and wasted energy.

Let’s explore how applying the Pareto Principle to your financial success can help you maximize efficiency and achieve your goals faster.

What is the Pareto Principle?

The Pareto Principle is all about recognizing that not all efforts yield equal results.

- 80% of Outcomes Come from 20% of Inputs: This means a small portion of your efforts leads to the majority of your success.

- It’s a reminder to focus on what’s truly effective and eliminate what isn’t.

Applying the Pareto Principle to Finance

- Prioritize High-Impact Activities

- Identify which financial actions yield the greatest results.

- For example, instead of focusing on cutting small expenses like coffee, work on boosting your income or investing wisely.

- Invest in High-Return Opportunities

- Not all investments are created equal.

- Focus on stocks, real estate, or ventures that historically deliver consistent, long-term growth.

- Eliminate Time-Wasting Habits

- Are you spending hours researching minor discounts but ignoring major savings opportunities?

- Redirect your energy to activities that align with your financial goals.

How to Identify Your 20%

- Track Your Spending and Earnings

- Use budgeting apps to analyze where your money is going.

- Identify the top 20% of your expenses or investments that contribute to 80% of your satisfaction or growth.

- Evaluate Income Streams

- Look at your income sources and determine which ones provide the highest returns.

- Focus on scaling these streams rather than spreading yourself too thin.

- Focus on Key Relationships

- Networking with mentors, advisors, or peers can open doors to valuable opportunities.

- A few strong connections often lead to the majority of your career or financial breakthroughs.

Maximizing the Pareto Effect in Daily Life

- Simplify Your To-Do List

- Instead of tackling 10 low-priority tasks, focus on the 2 that drive meaningful progress.

- Tools like Trello or Notion can help you organize and prioritize.

- Automate Repetitive Tasks

- Set up automatic savings, bill payments, and investment contributions.

- Freeing up mental energy allows you to focus on strategy and growth.

- Reinvest Your Gains

- Channel the returns from your most successful ventures into similar high-performing opportunities.

- This creates a cycle of exponential growth.

Pro Tips to Get Started

- Start Small: Begin by identifying one area of your finances where the 80/20 rule applies.

- Measure Your Results: Regularly review your efforts to ensure you’re focusing on what works.

- Stay Flexible: Your 20% may shift over time, so stay adaptable and open to change.

The Pareto Principle isn’t just a theory—it’s a mindset. By focusing on the 20% of your efforts that produce 80% of your results, you’ll unlock new levels of efficiency and financial growth. So, what’s your 20%? The sooner you identify and act on it, the faster you’ll move toward financial success.

Conclusion

Building wealth and achieving financial success isn’t about luck or chance—it’s about making intentional choices and sticking to proven principles. As we’ve explored, strategies like investing during crises, leveraging the power of compound interest, diversifying your portfolio, and creating multiple income streams can set you on a path to lasting prosperity.

But here’s the real question: how will you take what you’ve learned and put it into action? Whether it’s focusing on high-impact activities using the Pareto Principle or committing to strict financial discipline, the next steps are in your hands.

Remember, no financial journey is without challenges. There will be moments of doubt, setbacks, and obstacles. But with each small step—automating your finances, investing wisely, or simply spending less than you earn—you’re moving closer to the life you envision.

What’s most important is consistency. Wealth isn’t built overnight; it’s a steady climb fueled by smart decisions and the courage to stay the course. As you move forward, ask yourself: Which of these principles will I start implementing today? How can I turn today’s knowledge into tomorrow’s growth?

Your financial freedom starts with the choices you make now. So, take a deep breath, set your goals, and take that first step. The future you’re dreaming of is closer than you think—it’s time to claim it.

FAQ

1. What is the importance of investing during crises?

Investing during crises allows you to acquire undervalued assets and take advantage of market recoveries. It’s a strategy that many wealthy individuals use to grow their portfolios.

2. Why is saving alone not enough to build wealth?

Saving provides financial security but doesn’t generate significant growth. Investing allows your money to work for you, creating compounding returns over time.

3. What’s the difference between assets and liabilities in building wealth?

Assets generate income or appreciate in value, contributing to wealth creation. Liabilities, on the other hand, drain your finances without providing returns.

4. How does compound interest accelerate wealth building?

Compound interest reinvests earnings, creating exponential growth over time. Starting early and consistently reinvesting profits is key to maximizing its potential.

5. Why is diversification important in managing your portfolio?

Diversification reduces risk by spreading investments across different asset classes, sectors, or regions. This strategy helps protect your wealth from market volatility.

6. How can multiple income streams lead to financial success?

Multiple income streams provide financial security, accelerate wealth creation, and reduce dependence on a single source of income.

7. How does the Pareto Principle (80/20 rule) apply to personal finance?

The Pareto Principle focuses on prioritizing the 20% of efforts that yield 80% of results. In finance, this could mean identifying high-impact investments or cutting unnecessary expenses.