Are you tired of losing track of where your money goes each month? With the rise of digital tools, managing your finances doesn’t have to be a guessing game. Imagine having a tool right at your fingertips that helps you monitor every dollar, set financial goals, and stay on top of your budget—all without costing you a dime. That’s where Best free budgeting apps come in. These powerful tools are designed to simplify your life, providing insights into your spending habits and helping you make informed financial decisions.

In today’s fast-paced world, the best budgeting apps don’t just help you track your expenses; they empower you to plan for the future, avoid debt, and reach financial freedom. From intuitive trackers that categorize your spending to advanced budgeting tools that sync with your bank accounts, these apps cater to various financial needs and lifestyles. But with so many options out there, which one is the right fit for you? Let’s dive into a curated list of the top free budgeting tools and explore how they can transform your approach to money management.

Whether you’re saving for a dream vacation, paying off debt, or simply looking to stay on top of monthly bills, there’s a personal finance app for everyone. Ready to find the perfect app to help you take charge of your financial future?

Key takeaways

- Budgeting apps simplify financial management, offering tools to track spending, set goals, and monitor progress in real-time.

- Choosing the right budgeting app depends on your goals—whether for daily expense tracking, debt reduction, or saving for big goals.

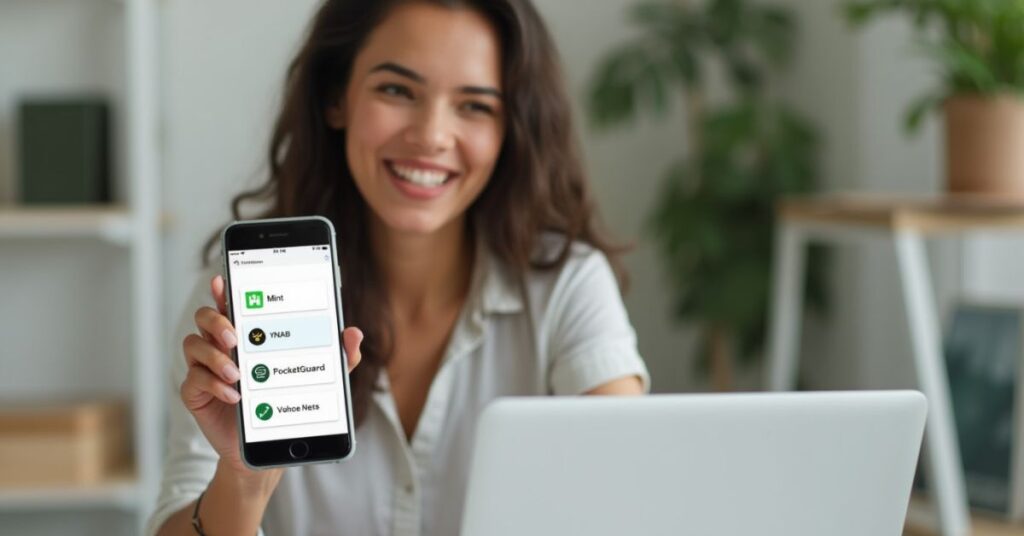

- Popular budgeting apps like Mint, YNAB, and PocketGuard offer unique features, from automatic syncing to goal-focused budgeting, catering to various needs.

- Setting realistic spending limits and tracking small expenses are essential habits for maximizing the effectiveness of your budgeting app.

- Regularly reviewing and adjusting your budget keeps it aligned with life changes, making it a powerful tool for achieving financial stability.

Why Budgeting Apps Are Essential for Financial Health

Ever wondered why so many people are turning to budgeting apps to manage their money? In a world where our expenses can quickly spiral out of control, having a tool that keeps tabs on spending can make a huge difference. Free budgeting apps have become the go-to solution for individuals seeking a better grasp on their finances, helping to create order out of financial chaos. But why exactly are these apps so essential?

Benefits of Using a Budget Tracker App

Budgeting apps offer numerous advantages beyond just tracking where your money goes. Here’s a look at some key benefits:

- Expense Tracking Made Easy: No more guessing or end-of-the-month surprises. Budgeting apps like Mint and PocketGuard automatically categorize your expenses, giving you a clear picture of your spending habits.

- Goal Setting and Monitoring: Planning a big purchase, saving for a vacation, or working towards debt freedom? The best budgeting apps let you set goals, track your progress, and adjust as needed. This makes reaching your financial goals more achievable, step by step.

- Real-Time Financial Insights: With live syncing to your bank account, you get instant access to your spending data, allowing you to make informed decisions on the spot.

Do You Really Need a Budgeting App?

If you’ve ever wondered where your money went by the end of the month or found yourself dipping into savings, a budget tracker app can offer clarity and control. Rather than relying on manual tracking or mental math, these tools do the heavy lifting, ensuring that every expense is accounted for and every financial goal is within reach.

Consider these questions to see if a budgeting app might benefit you:

- Do you find it challenging to keep up with all your expenses?

- Are you trying to save for a specific goal but struggle to stay on track?

- Do you want to understand your spending patterns better?

If you answered “yes” to any of these, using a personal finance app could be a game-changer for your financial journey.

Key Features to Look for in a Budgeting App

With hundreds of apps available, choosing the right one can be overwhelming. Here are a few must-have features to keep an eye on:

- User-Friendly Interface: The best budgeting tools make it easy to navigate, even for those who aren’t tech-savvy.

- Customizable Categories: Look for apps that allow you to personalize spending categories based on your lifestyle.

- Data Security: Ensure your data is protected with secure encryption, especially if you’re syncing with bank accounts.

Budgeting apps have revolutionized the way we handle money, turning tedious tasks into straightforward, automated processes. With the right tool, you can transform how you manage your finances, giving yourself the freedom to make choices confidently and stay in control of your financial future.

Ready to dive into the world of budgeting apps and take charge of your spending? Let’s explore some of the best options out there.

Best Free Budgeting Apps to Consider

When it comes to managing your finances, not all budgeting apps are created equal. Each app has unique features designed to cater to different financial needs, whether you’re trying to stay on top of daily expenses or save for a long-term goal. Here are some of the top free budgeting apps worth considering to help you take control of your spending.

1. Mint: Comprehensive Budgeting with Automatic Syncing

Mint is one of the most popular budgeting tools, and for good reason. With its seamless integration with bank accounts, credit cards, and bills, Mint pulls all your financial information into one place, making tracking your expenses easy and intuitive.

- Automatic Categorization: Mint automatically categorizes your transactions, so you get a clear overview of where your money goes.

- Custom Alerts: Receive notifications for bill reminders, unusual spending, and budgeting tips tailored to your financial habits.

- Credit Score Tracking: Mint also provides free access to your credit score, helping you monitor your financial health on a broader level.

Mint’s ability to automate and categorize spending makes it ideal for those who want a hands-off approach to budgeting.

2. YNAB (You Need a Budget): Goal-Focused Budgeting

If you’re serious about building better financial habits, YNAB (You Need a Budget) takes a unique approach by emphasizing goal-oriented budgeting. YNAB’s method encourages users to give every dollar a purpose, ensuring that you’re actively managing your money rather than passively tracking it.

- Goal-Based Budgeting: YNAB helps you prioritize spending based on your financial goals, such as paying off debt or saving for emergencies.

- Real-Time Syncing: Available across multiple devices, YNAB allows you and your partner to stay updated on finances at all times.

- Detailed Reporting: Track your financial progress with in-depth reports that show spending patterns and budget trends.

While YNAB does require more user involvement, it’s highly effective for those committed to reaching specific financial goals.

3. PocketGuard: Simple Interface for Spending Control

PocketGuard is perfect for users who prefer a minimalist approach to budgeting. Its straightforward layout and real-time updates make it easy to see how much you can spend at any moment.

- In My Pocket Feature: PocketGuard calculates your disposable income by subtracting bills, goals, and savings from your income, showing what’s available to spend.

- Bill Negotiation: PocketGuard offers a unique feature that helps you negotiate and lower bills, saving you more money each month.

- Secure Banking Integration: Like other apps, PocketGuard securely links to your bank account, keeping your information safe.

For those looking to quickly understand their financial standing, PocketGuard is an excellent choice.

4. Goodbudget: Envelope Budgeting for Shared Finances

Goodbudget is a modern take on the classic envelope budgeting system, where you allocate portions of your income to specific spending categories. It’s especially useful for couples or shared households, as it allows syncing across multiple devices.

- Digital Envelope System: Divide your income into categories like rent, groceries, and entertainment, helping you visualize your budget.

- Syncing Across Devices: Share your budget with family members to ensure everyone stays on the same financial page.

- Debt Tracking: Goodbudget also includes tools to help you manage and pay down debt, making it a comprehensive financial tool.

Goodbudget’s envelope system is ideal for those who want to stick to a strict budget without surprises.

5. Personal Capital: Budgeting with Investment Tracking

Personal Capital combines traditional budgeting with investment management, making it a perfect choice if you’re looking to build wealth. In addition to tracking daily expenses, Personal Capital offers insights into your investment portfolio, including 401(k) and IRA accounts.

- Net Worth Calculator: Track your net worth over time and see how your investments are contributing to your financial growth.

- Retirement Planning Tools: Personal Capital includes a retirement planner, helping you understand your long-term financial health.

- Spending and Cash Flow: Analyze your income and expenses to make informed decisions about your spending habits.

If you’re interested in a tool that blends budgeting and investment tracking, Personal Capital is an excellent choice.

Each of these free budgeting apps offers unique features to suit different financial needs and preferences. By exploring their strengths and finding the right fit, you’ll be better equipped to track your spending, set financial goals, and make smarter money decisions. Which one resonates with you?

How to Choose the Right Financing Option for Your Life Coaching Business

Choosing the right budgeting app can feel overwhelming with so many options on the market. Each app brings something unique to the table, but the best choice ultimately depends on your financial goals, lifestyle, and budgeting habits. So, how can you find the perfect fit? Here are a few simple steps and factors to consider when selecting the right budgeting tool for your needs.

1. Assess Your Financial Goals

Start by identifying what you want to achieve with a budgeting app. Are you primarily looking to track daily expenses, or do you need a tool that can help you save for larger goals, like buying a home or starting a business? Different apps offer unique features tailored to specific financial goals, so clarifying your objectives will help you narrow down the options.

Ask yourself:

- Do I need help with daily expense tracking or long-term financial planning?

- Am I focused on debt reduction, saving, or investment growth?

For example, if you’re prioritizing debt reduction and strict budgeting, a goal-focused app like YNAB might be your best choice.

2. Evaluate Key App Features

Once you’ve set your goals, consider the features that will support them. Not all budgeting apps are created equal, and some offer additional tools that can make a big difference in your financial journey. Here are a few essential features to look for:

- Automatic Transaction Syncing: Save time by choosing an app that links directly to your bank accounts and credit cards, updating transactions automatically.

- Customizable Categories: Look for apps that let you personalize spending categories according to your lifestyle, making it easier to stay on track.

- Financial Alerts and Notifications: Some apps, like Mint, send alerts when you’re approaching your budget limit or when unusual transactions occur, helping you avoid overspending.

- Reports and Analytics: If you want to analyze spending trends, choose an app with detailed reporting features. This will allow you to see where your money goes and adjust as needed.

3. Determine Your Comfort Level with Technology

Are you comfortable using more complex apps, or do you prefer something simple and straightforward? Some apps, like PocketGuard, offer a minimalist approach, while others, like Personal Capital, come with a range of tools that may require a learning curve.

Consider:

- Do you prefer an intuitive, easy-to-use interface, or are you willing to navigate a more complex setup?

- Would you benefit from a tutorial or customer support to help you get started?

If you’re new to budgeting apps, selecting one with a clean, user-friendly design can make the transition easier.

4. Review Security and Privacy Measures

When it comes to financial data, security is paramount. Choose an app that prioritizes data protection, with features like bank-level encryption, two-factor authentication, and secure login methods. Look for apps that have a solid reputation for protecting user data.

Ask these questions:

- Does the app offer encryption to safeguard my data?

- Are there user reviews or ratings that verify its security?

Apps like Mint and Personal Capital are known for their strong security protocols, making them reliable choices for users concerned about privacy.

5. Test Compatibility with Your Devices

It’s important to choose an app that syncs seamlessly across your devices, especially if you prefer tracking your finances on both your phone and desktop. Most budgeting apps offer cross-platform compatibility, but it’s always worth double-checking that your chosen app works with your preferred devices.

Look for:

- Cross-device syncing: Ensure you can access your budget from both your mobile device and computer.

- System requirements: Verify that the app is compatible with your operating system.

For instance, if you often switch between devices, an app like YNAB, which offers reliable cross-platform compatibility, can enhance your budgeting experience.

By following these steps, you can confidently select the best budgeting app tailored to your personal needs. Whether you prioritize simplicity, goal-setting, or advanced analytics, finding the right fit can make a real difference in your financial management. Ready to dive into budgeting?

Tips for Getting the Most Out of Your Budgeting App

Once you’ve chosen the perfect budgeting app, the next step is to make sure you’re using it to its fullest potential. A budgeting app is only as effective as the habits you build around it, and a few strategic steps can help you get the most out of this powerful tool. Here’s a guide to setting up and optimizing your app experience for maximum impact on your financial health.

1. Set Up Budget Categories That Match Your Lifestyle

One of the best ways to personalize your budgeting app is by setting up budget categories that align with your unique spending habits. Most apps allow you to create or customize categories, so take the time to reflect on where your money goes each month. Are you spending more on dining out, entertainment, or transportation? Tailoring categories makes it easier to track what matters most to you.

Tip: Use specific categories like “Dining Out,” “Health & Fitness,” or “Kids’ Activities” rather than generic ones. This will give you a clearer picture of where your money goes.

2. Create Spending Limits for Each Category

After setting up your categories, determine a realistic spending limit for each. Many budgeting apps let you assign monthly limits to help keep you accountable. For instance, if you know you’d like to cut back on takeout, set a lower limit for “Dining Out” and monitor your progress throughout the month.

Why it works: Setting spending limits is an effective way to stick to your financial goals while building self-awareness around your spending patterns. Plus, the app’s alerts can help remind you if you’re nearing your limit.

3. Track and Review Transactions Regularly

Consistency is key when it comes to budgeting. Make it a habit to check your app regularly—whether that’s daily or weekly—to review recent transactions and see how you’re doing in each category. Keeping an eye on your expenses in real-time can help prevent overspending and ensure you’re on track.

Quick Tip: Many users find it helpful to set a reminder for weekly check-ins. This keeps you engaged with your budget and helps you catch any unexpected expenses early on.

4. Set Financial Goals Within the App

Most budget tracker apps include goal-setting features, which allow you to allocate funds toward specific savings goals, like a vacation or emergency fund. These goals can be a powerful motivator, and seeing your progress can encourage you to stay disciplined.

Consider setting goals like:

- Short-Term Goals: Building a $1,000 emergency fund or saving for holiday gifts.

- Long-Term Goals: Saving for a down payment on a house or creating a retirement nest egg.

Pro Tip: Adjust your goals as needed! Financial priorities can change, so feel free to revisit and modify your goals over time.

5. Use Spending Insights to Make Adjustments

Budgeting apps typically provide insights and reports on your spending habits, offering a breakdown of where your money goes each month. Take advantage of these reports to spot trends and make informed decisions about your finances. Are you consistently overspending on groceries or transportation? Adjust your budget to reflect these insights.

Actionable Insight: If you’re spending more than expected in one area, try compensating by adjusting another category. This flexibility can make budgeting feel more manageable and realistic.

6. Enable Notifications for Real-Time Alerts

Many budgeting apps offer customizable alerts to notify you of important updates, like when you’re close to exceeding a category limit or when a bill is due. Turning on these notifications can keep you proactive about your finances, helping you avoid late fees and curb unnecessary expenses.

Why it’s beneficial: Alerts keep you informed without requiring you to check the app constantly. They act as gentle reminders to keep you on track, even during busy days.

7. Reflect on Your Progress Each Month

Finally, take time at the end of each month to review your financial performance. Did you meet your spending goals? Are there categories that need adjustment? Reflecting on your budgeting journey allows you to celebrate small wins and identify areas for improvement, keeping you motivated.

Simple Tip: Record your achievements and challenges in a monthly financial journal to track your progress and stay engaged with your goals.

Using these tips, you can transform a simple personal finance app into a comprehensive tool for managing your money. Remember, budgeting is a journey—it takes time, patience, and commitment. By taking full advantage of your budgeting app’s features, you’re one step closer to achieving financial freedom and gaining control over your spending. Ready to start seeing results?

Mistakes to Avoid When Using a Budgeting App

While budgeting apps are powerful tools that can help you take control of your finances, they’re not foolproof. Missteps can happen, and some common mistakes can limit the effectiveness of these apps in reaching your financial goals. Avoiding these pitfalls can make a big difference in how much you benefit from using a budgeting app. Let’s take a look at some of the most common mistakes and how to steer clear of them.

1. Ignoring Small Transactions

It’s easy to overlook small purchases, thinking they don’t add up to much. However, those daily coffee runs, quick snacks, and impulse buys can silently drain your budget over time. Ignoring these expenses can give you a false sense of your actual spending, causing you to overshoot your budget.

Solution: Log every transaction, big or small. Many budget tracker apps allow you to set up categories for minor expenses, helping you track these seemingly “harmless” purchases and revealing where small cuts can save you money.

2. Setting Unrealistic Budget Limits

We all want to save more and spend less, but setting overly ambitious limits can backfire. If you restrict yourself too much in areas like food, entertainment, or transportation, you may find it challenging to stick to the budget, leading to frustration and possibly giving up.

Solution: Start with realistic limits based on your spending habits over the past few months. Use the budgeting app’s insights to identify where slight reductions are possible without making drastic changes. Over time, you can gradually adjust your limits as you become more comfortable with budgeting.

3. Failing to Review and Adjust Your Budget

A budget isn’t something you set and forget. Life changes, and so do your expenses—whether it’s a pay raise, a new monthly subscription, or a change in rent. If you fail to review and adjust your budget regularly, you might find it harder to stay on track or meet new financial goals.

Solution: Make a habit of revisiting your budget each month to reflect any lifestyle changes. Adjust your limits accordingly, keeping your financial goals in focus. Regular check-ins keep your budget relevant and realistic.

4. Not Utilizing All Available Features

Many users only scratch the surface of what their budgeting app can do, sticking to basic expense tracking without exploring additional features. Most personal finance apps offer powerful tools like goal setting, debt tracking, and spending alerts, which can make budgeting easier and more effective.

Solution: Take time to explore all the features your app offers. Set goals, enable alerts, and check for reports on spending patterns. By fully utilizing these tools, you’ll get a clearer view of your financial health and make better-informed decisions.

5. Focusing Only on Expenses Without Setting Goals

Tracking expenses alone won’t get you to your financial goals. Without a plan, it’s easy to fall into the habit of “watching” your money without actively working toward anything meaningful. Setting goals, whether for savings, debt reduction, or investments, adds direction to your budgeting efforts.

Solution: Use your budgeting app’s goal-setting features to define specific targets. For instance, if you want to save $1,000 in three months, break it down into achievable weekly or monthly savings goals. This way, you have a clear roadmap for success and motivation to stay committed.

6. Relying Solely on the App Without Developing Good Habits

A budgeting app can track expenses, but it won’t build good financial habits for you. Relying solely on an app to manage your finances without learning budgeting principles can be a mistake, as it may leave you without the knowledge to maintain financial health long-term.

Solution: Complement your app use with practical financial education. Learn the basics of budgeting, saving, and spending wisely. By building strong habits, you’ll be more likely to reach your goals and stay financially secure, even if you stop using the app someday.

By steering clear of these common mistakes, you can make the most of your budgeting app and set yourself up for financial success. Remember, a budgeting app is a tool, and like any tool, it’s most effective when used thoughtfully. Focus on small, steady improvements, and you’ll find yourself in a better financial position over time. Ready to master your budgeting app and take control of your finances?

Conclusion

In today’s world, where every dollar counts, finding the right tools to manage your finances can make all the difference. By choosing a free budgeting app that aligns with your goals, you’re taking a powerful step toward financial freedom. Think about how much easier it will be to track expenses, set meaningful goals, and gain insights into your spending—all from your phone or computer. Imagine the peace of mind you’ll feel knowing exactly where your money goes and that you’re actively working toward a brighter financial future.

But remember, no app is a magic solution. It’s about making intentional choices, adjusting as you go, and avoiding common budgeting mistakes. As you integrate this tool into your daily routine, don’t forget that consistency is key. Make time to review, adjust, and celebrate your progress, no matter how small. These small actions build the habits that lead to long-term success.

So, are you ready to take control of your finances? Whether you’re aiming to save for a major purchase, pay off debt, or simply understand your spending habits better, there’s a personal finance app out there to support you. The journey to financial freedom might seem challenging, but with the right tools and a commitment to growth, you can achieve it. Start today, stay consistent, and watch as you transform your financial future—one budgeting choice at a time.

FAQ

What is a budgeting app?

A budgeting app is a digital tool that helps you manage your finances by tracking your income, expenses, and savings. It provides insights into spending habits and helps you set and achieve financial goals.

How does a budgeting app work?

Budgeting apps sync with your bank accounts and credit cards to automatically categorize transactions. They let you set budgets for different spending categories and track your progress in real time.

What are the benefits of using a budgeting app?

Budgeting apps simplify financial tracking, help you avoid overspending, and assist in reaching savings goals. They offer features like notifications, spending insights, and goal-setting tools for better financial management.

Which budgeting apps are the most popular?

Some popular budgeting apps include Mint, YNAB (You Need a Budget), PocketGuard, and Personal Capital. Each app offers unique features tailored to different financial needs.

How do I choose the right budgeting app for me?

Consider your financial goals, preferred features, and ease of use. Some apps are better for tracking expenses, while others focus on goal setting or investment management. Select an app that matches your financial priorities.

Can I use a budgeting app on multiple devices?

Yes, most budgeting apps are compatible across devices, including smartphones, tablets, and desktops. This allows you to track your finances from anywhere.

Are budgeting apps secure?

Most budgeting apps use encryption and two-factor authentication to keep your financial data secure. Look for apps with strong security features and positive user reviews for additional peace of mind.

What mistakes should I avoid when using a budgeting app?

Avoid setting unrealistic budget limits, ignoring small transactions, and failing to review your budget regularly. Regular check-ins and realistic goals can help you get the most from your app.

Do budgeting apps help with debt reduction?

Yes, many budgeting apps include debt-tracking features to help you manage and pay off debts. They provide insights on payments, interest, and progress, making it easier to stay on top of debt repayment.

Can a budgeting app improve my financial habits?

Absolutely. Budgeting apps encourage consistent tracking and spending awareness, helping you develop better financial habits over time. By regularly using an app, you can gain control over your finances and work towards financial stability.