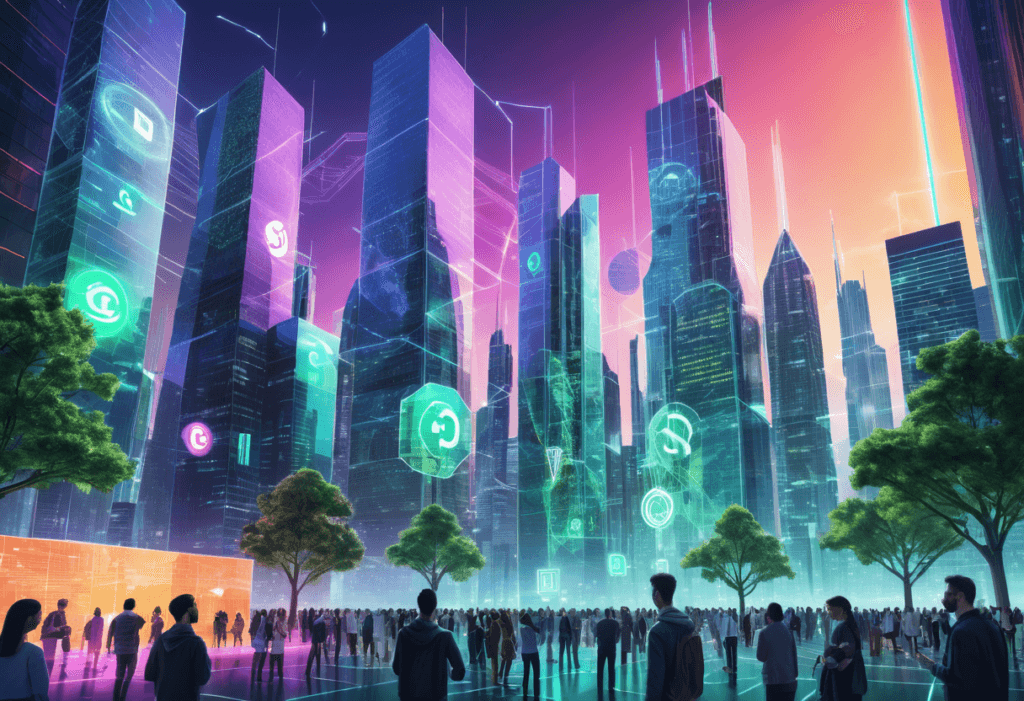

Imagine a world where financial freedom is a daily reality. Where getting financial services doesn’t rely on banks but on smart tech and openness. Welcome to Decentralized Finance, or DeFi, a new way powered by blockchain, changing finance forever.

At DeFi’s heart is blockchain finance, making direct transactions possible. It gives people more power than ever before. If you’ve dealt with high bank fees or slow financial services, DeFi offers a better way. It lets you manage your digital assets securely and efficiently.

This isn’t just for tech lovers. It’s for anyone who wants financial freedom without old-school bank rules.

Key Takeaways

- DeFi marks a big change from old finance, using blockchain for better openness and speed.

- It lets people do financial things on their own, without banks in the middle.

- It includes cool stuff like decentralized exchanges, yield farming, and lending/borrowing.

- But DeFi also has its challenges, like smart contract bugs and market ups and downs.

- Big names like Aave and Uniswap show DeFi’s real benefits and growing use.

Introduction to Decentralized Finance (DeFi)

Decentralized finance, or DeFi, started in 2018. It lets people trade without needing banks or middlemen. This is thanks to new tech like blockchain and cryptocurrencies.

Ethereum, launched in 2015, was the first blockchain that could run programs. This led to DeFi apps and services. Now, you can do things like pay bills, trade, and lend money directly to others.

“In the US, the top 10% of households by net worth own over 85% of equities, while the bottom 50% own less than 1%.”

DeFi aims to fix old money problems. It lets more people manage their money without needing banks. This means you can use financial services without dealing with lots of rules.

Billions of dollars are locked in DeFi services. This shows people trust these new systems. For example, Aave lets you lend and borrow digital assets. dYdX Chain lets you trade cryptocurrency with up to 20x leverage.

DeFi also helps people worldwide who can’t get bank services. In 2017, 1.7 billion adults didn’t have bank accounts. In the US, 22% of people can’t get bank services. DeFi is a big step towards making money services fair for everyone.

Key Components of DeFi

Decentralized Finance (DeFi) is built on three main parts: cryptocurrencies, blockchain technology, and smart contracts. Each part is key to making DeFi work well, safely, and openly.

Cryptocurrencies

Cryptocurrencies are the heart of DeFi. They are digital money that can be moved, traded, and used online. They make transactions fast and cheap, opening up financial services to more people.

Blockchain Technology

Blockchain is the backbone of DeFi. It uses a shared ledger to record all transactions safely and forever. This way, there’s no need for a single boss, making things more open and less prone to scams. It helps DeFi apps like exchanges and lending work well.

Smart Contracts

Smart contracts are programs that do things on their own when certain rules are met. They make sure deals are done right, without needing banks or middlemen. This lets DeFi offer cool stuff like insurance and synthetic assets.

DeFi uses these parts to build a new financial world. It’s all about tokenization and a shared ledger, opening up new chances for developers and users. For more on DeFi, check out the comprehensive guide to decentralized finance.

How Decentralized Finance (DeFi) Works

Decentralized Finance (DeFi) uses peer-to-peer networks, cutting out middlemen. It relies on blockchain for security and openness. Knowing how it works is key for those interested in DeFi.

Peer-to-Peer Transactions

Peer-to-peer networks let users deal directly, without banks. This way, people keep control over their money. Automated market makers help by adding liquidity to exchanges.

Security Protocols

DeFi’s security is vital. Smart contracts on blockchain ensure transactions are safe. They handle tasks like lending and borrowing securely.

Blockchain Integration

Blockchain is DeFi’s core. It keeps all transactions safe and open. Ethereum, for example, helps dApps run smoothly.

DeFi is changing finance fast, as Fidelity’s DeFi resource explains. It brings new levels of openness, ease, and speed to money dealings.

Popular DeFi Applications

Decentralized finance (DeFi) is growing fast. Certain apps are leading the way. These include decentralized exchanges (DEXs), yield farming, and lending and borrowing platforms. They offer new ways to interact with and profit from finance.

Decentralized Exchanges (DEXs)

DEXs let users trade cryptocurrencies without a central authority. Uniswap is a top choice for its easy trading. It’s also the go-to for options trading.

Automated market making is key. It makes trading smooth and continuous. This is thanks to liquidity providers.

Yield Farming

Yield farming lets users earn rewards by staking crypto. Aave is a leader in this field. It automates finding the best returns across different chains.

It also compounds interest automatically. This makes it easy and efficient. Curve Finance is known for stablecoin swaps. It offers low fees and slippage, improving the yield farming experience.

Decentralized Lending and Borrowing

Decentralized lending and borrowing offer new ways to get loans and earn income. Aave is the top platform by TVL. It offers efficient lending protocols.

GMX helps with secure lending and borrowing of cryptocurrencies. These platforms use smart contracts. They ensure everything is transparent and automated, a strong alternative to traditional finance.

Benefits of DeFi

Decentralized Finance (DeFi) is changing the world of money. It makes financial inclusion better. The World Bank says 1.7 billion adults can’t use banks because of paperwork and lack of bank branches, mainly in Africa. DeFi lets anyone with the internet join the financial world.

Transparency and Security

DeFi shines because of its blockchain transparency. The 2008 crisis showed us the dangers of hidden money dealings. DeFi uses blockchain to keep everything open and secure. Every deal is recorded, making it easier to trust the system.

Programmable Money and Automation

Programmable money and smart contracts automation are big steps forward. Old banking is slow and not very flexible. Smart contracts make deals happen automatically, cutting out middlemen and saving money.

This makes it easier for people to manage their money on their own. DeFi lets users create their own financial products. It’s making money more open, secure, and easy for everyone to use.

Risks and Challenges in DeFi

Decentralized Finance (DeFi) has changed the financial world, aiming to offer new services without middlemen. But, it faces many challenges. Risks in DeFi affect its stability and growth. Learn more about these risks here.

Smart Contract Vulnerabilities

Smart contracts are key in DeFi, handling complex transactions without middlemen. Yet, they can be vulnerable. Bad coding can cause big losses from hacks or system failures.

There’s no central body to oversee, so developers and users must ensure security. MEV (Miner Extractable Value) is a big risk, where miners reorder transactions for profit, making smart contracts more vulnerable.

Regulatory Uncertainty

The rules for cryptocurrencies are changing and unclear, affecting DeFi. This uncertainty risks projects and participants as laws vary worldwide and change. DeFi’s decentralized nature makes it hard for governments to enforce rules.

This uncertainty might scare away big investors and slow DeFi’s growth.

Market Volatility

Market ups and downs are common in crypto, and DeFi is no different. The use of leverage makes these swings bigger, affecting asset values a lot. Stablecoins help by reducing the need for constant currency changes.

But, DeFi lacks the shock-absorbing features of traditional finance. So, market shocks can hit harder and faster, affecting liquidity and stability.

DeFi’s challenges mean we need careful risk management and strong security. We must balance innovation with safety. DeFi’s growth will shape finance, but we must watch its risks and work to fix them.

Top DeFi Platforms to Explore

The rise of decentralized finance has brought about top DeFi platforms. These platforms are changing the financial world. They let users earn interest, borrow, and trade without a middleman.

The Aave liquidity protocol, Uniswap exchange, and Compound finance are key players. They offer a range of financial services.

Aave

Aave is known for its Total Value Locked (TVL) of $5.49 billion and 549,500 community members. It’s famous for flash loans, where users can borrow without collateral. Aave’s decentralized lending pools offer flexible borrowing and lending options.

Uniswap

Uniswap is a top DeFi platform with a TVL of $3.31 billion and 4.5 million followers. It’s an automated liquidity protocol for easy token swaps and trading. Uniswap’s user-friendly interface and open nature make it essential in DeFi.

Compound

Compound finance has a TVL of $2.07 billion and 850,000 followers. It’s known for its algorithmic interest rates. Compound lets users supply and borrow cryptocurrencies, with rates changing based on demand.

The DeFi industry has almost $44 billion locked in various applications. This shows its fast growth and adoption. Exploring Aave, Uniswap, and Compound lets users see DeFi’s innovation and benefits.

The Future of Decentralized Finance (DeFi)

The future of DeFi looks bright, ready to overcome current challenges and grow. New developments are on the horizon, shaping the DeFi world. Scalability solutions like Ethereum 2.0 and Layer 2 scaling will cut costs and speed up transactions.

Blockchain innovation is key, with Ethereum leading the way. Launched in 2013, Ethereum supports smart contracts, automating financial tasks. Its Solidity language has helped DeFi grow, with many projects keeping tokens for speculation and security.

DeFi has seen huge growth, with a 780% increase in Ethereum blockchain activity in 2021. Over $90 billion was deposited into Ethereum DeFi protocols. This growth is backed by over 35 million Ethereum coins locked in DeFi protocols last year.

Educational efforts have also boosted DeFi. Duke University’s “Decentralized Finance (DeFi): The Future of Finance Specialization” has attracted 30,749 learners. The course covers vital topics like token design and governance, preparing learners for DeFi’s future.

Experts like Peter Grosskopf see DeFi expanding into new areas. With ongoing scalability and blockchain innovation, DeFi will change finance. It will offer better cost, speed, and access to everyone.

Integrating DeFi with Traditional Finance

The mix of DeFi with traditional finance is a big step forward. It aims to connect old financial systems with new blockchain services. This creates new chances and abilities.

Partnerships with Financial Institutions

Key to DeFi’s growth are partnerships with banks and other financial groups. These teams bring needed rules and customers. Together, they make new financial products that are better for everyone.

Scalability Solutions

DeFi faces a big problem: it can’t handle many transactions. New solutions like layer-2 tech and better rules are being worked on. These aim to speed up and lower costs, making DeFi more useful.

User-Friendly Interfaces

For DeFi to succeed, it needs easy-to-use platforms. Many people find DeFi hard because they’re used to old ways. So, making DeFi simple is a big goal. This will help more people use it, growing the DeFi world.

The blend of DeFi and traditional finance is very promising. By solving scalability issues, making partnerships, and making DeFi easy to use, we’re on the verge of a big change. This change will come from combining old and new financial systems.

DeFi’s Impact on Global Finance

Decentralized Finance (DeFi) is changing the financial world with blockchain and smart contracts. It offers new services that challenge old banks. This helps more people get financial help, making the world more connected and fair.

DeFi makes it easier for people everywhere to get financial help. It uses apps and platforms for things like lending and earning interest. This way, DeFi cuts out middlemen, saving money and making things faster.

Enhanced Financial Accessibility

DeFi makes it easier for everyone to access money. Old banks often leave people out because of where they live or how much money they have. But DeFi lets anyone with the internet use financial services, helping those in need most.

Reduction of Transaction Costs

DeFi also makes money transactions cheaper. Banks use many middlemen, which slows things down and costs more. But DeFi uses blockchain to skip these steps, making things faster and cheaper.

Global Financial Inclusion

DeFi focuses on making money services available worldwide. It has grown a lot, thanks to more people using cryptocurrencies and apps. This helps everyone, not just the rich, to start businesses and grow the economy.

The global impact of DeFi is huge. It’s making the financial world better by making money services more available, cheaper, and fairer for all.

Case Studies and Success Stories in DeFi

The field of decentralized finance (DeFi) has seen big changes. These changes are thanks to In 2021, assets locked in DeFi went from $600 million to $19.72 billion. This shows how fast DeFi is growing and succeeding.

Examples of DeFi Adoption

Many DeFi adoption case studies show it’s being accepted by traditional finance. The DAO market, which is now bigger than DeFi, shows how fast decentralized organizations are growing. Also, DEX trading volume has jumped to over 15% of the market by October. This shows more people are using decentralized exchanges.

Yield Farming Success Stories

Yield farming has become very profitable, with many yield farming achievements showing big gains. For example, Yearn Finance Token (YFI) saw a huge price jump of one million percent in just two weeks. Uniswap and Compound are also big players, with almost 50% of DAI locked as collateral.

Real-World Applications

Real-world DeFi applications show DeFi’s practical benefits. Tokenized bonds, decentralized insurance, and partnerships like Binance and Kava are big wins. Also, Web3 technologies, like Ankr’s staking integration, show DeFi’s future.

These examples and DeFi success stories show DeFi is solving real financial problems. It’s making finance more open, fair, and efficient.

Conclusion

The growth in decentralized finance shows a big change towards a more open and secure financial system. DeFi uses blockchain technology to bring financial inclusion and remove middlemen. This makes transactions safe and opens up new financial possibilities.

DeFi’s growth brings many benefits but also risks. Issues like smart contract bugs and legal problems need attention. Yet, DeFi’s advantages, like avoiding censorship and saving money on transactions, make it worth exploring.

As DeFi keeps evolving, rules will be key in guiding its future. Finding a balance between new ideas and safety is essential for growth. The excitement around DeFi worldwide shows its huge promise. It’s set to change traditional finance and markets in big ways.

FAQ

What is Decentralized Finance (DeFi)?

DeFi is a new way of doing finance, different from old systems. It uses secure ledgers like those for cryptocurrencies. This means you can do financial things without banks or other middlemen.

How does DeFi work?

DeFi uses networks where people deal directly with each other, without banks. It uses blockchain to keep transactions safe and clear. This makes financial dealings easy and safe, using digital wallets and keys.

What are the key components of DeFi?

DeFi is based on three main things: Cryptocurrencies, which are digital money; Blockchain, a secure ledger; and Smart Contracts, which are like self-running rules for money.

What are some popular applications of DeFi?

DeFi has many uses, like Decentralized Exchanges for trading without banks. There’s also Yield Farming, where you can earn by lending crypto. And there are platforms for lending and borrowing money using smart contracts.

What are the benefits of using DeFi?

Using DeFi has many advantages. It makes money services available to more people, thanks to the internet. It also keeps transactions safe and clear, thanks to blockchain. Plus, smart contracts make money work automatically.

What are the risks associated with DeFi?

DeFi has some risks, like problems with smart contracts that can lead to theft. There’s also uncertainty about laws and how they apply to DeFi. And, the value of assets can change a lot.

What are some top DeFi platforms to explore?

Some top DeFi platforms are Aave for lending, Uniswap for trading, and Compound for earning interest. These platforms let you do different financial things in a new way.

How does DeFi integrate with traditional finance?

DeFi is working with old finance by teaming up with banks and making things easier to use. This helps people move from old ways to new ones more easily.

What is the future of DeFi?

DeFi’s future looks bright with better technology and working with old finance. Things like Ethereum 2.0 will help solve problems like high costs and slow speeds. This will make DeFi even more important in finance.

How does DeFi impact global finance?

DeFi changes finance worldwide by making it easier for more people to access money. It also makes transactions cheaper and helps everyone get financial services, making things fairer.

Are there any success stories in DeFi?

Yes, DeFi has many success stories. For example, banks are using DeFi, people are making a lot of money from Yield Farming, and DeFi is solving real problems like insurance. These stories show how DeFi is changing finance for the better.