Are you tired of sifting through countless insurance options, unsure of which one truly fits your needs? You’re not alone. Choosing the right coverage can feel overwhelming, but that’s where MyFastBroker Insurance Brokers come in. As experts in simplifying complex choices, they act as your trusted guide, helping you find tailored solutions with ease.

Whether you’re looking to protect your home, business, or future, MyFastBroker connects you with policies that work for you—not the other way around. But why choose them? What makes their approach different? Let’s explore how this innovative brokerage is redefining the insurance experience and why it could be the perfect partner for your protection needs.

Key Takeaways

- MyFastBroker Insurance Brokers simplify the often-complex process of finding the right insurance policy.

- They offer personalized solutions by tailoring policies to your unique needs and budget.

- With access to multiple top-tier insurance providers, MyFastBroker ensures competitive pricing and extensive coverage options.

- Their expert team provides clear guidance, breaking down complex terms for better understanding.

- MyFastBroker supports you through every stage, from onboarding to claims assistance, ensuring a stress-free experience.

- Partnering with MyFastBroker saves time, money, and effort, giving you confidence in your insurance decisions.

Understanding the Role of Insurance Brokers

Have you ever wondered what truly sets an insurance broker apart from the countless online platforms promising quick coverage? Many people assume they can navigate the insurance world on their own, but with so many options and confusing terms, it’s easy to feel lost. That’s where insurance brokers like MyFastBroker shine—they bring expertise and personalized solutions to the table, saving you both time and money.

Here’s why working with an insurance broker can make all the difference:

- Personalized Recommendations: Unlike generic comparison tools, brokers take the time to understand your unique needs. Whether you’re insuring your car, home, or business, they tailor policies specifically to your lifestyle and budget.

- Access to a Broader Market: Did you know brokers have connections to multiple insurers? This gives you access to options you might not find on your own, ensuring you get the best deal possible.

- Expert Guidance: Insurance jargon can be overwhelming—what’s the difference between liability and comprehensive coverage? Brokers break it down in plain language, helping you make confident decisions.

Why It Matters

Think of an insurance broker as your personal advocate in the world of insurance. Instead of settling for cookie-cutter policies, you get a plan that actually works for you. And with MyFastBroker Insurance Brokers, the process becomes even more seamless. Their team of experts goes beyond the basics, delivering value through unmatched service and a commitment to finding the best-fit solutions.

So, why navigate this confusing world alone when you can have a professional by your side? It’s time to discover how MyFastBroker can simplify and elevate your insurance experience.

Why Choose MyFastBroker?

When it comes to selecting an insurance broker, you have countless options—but not all brokers are created equal. So, what makes MyFastBroker stand out? It’s not just about their impressive range of services; it’s about the way they approach your unique needs with care, professionalism, and a commitment to delivering the best possible outcomes.

What Sets MyFastBroker Apart?

Let’s take a closer look at the standout features that make MyFastBroker a trusted name in the insurance industry:

- Tailored Solutions for Every Client:

Unlike one-size-fits-all platforms, MyFastBroker takes the time to understand your individual circumstances. Whether you’re looking for comprehensive coverage for your business or an affordable personal insurance plan, they craft solutions that fit seamlessly into your life. - Industry Expertise You Can Trust:

MyFastBroker Insurance Brokers are seasoned professionals who know the ins and outs of the insurance world. Their deep industry knowledge means they can guide you through even the most complex policies with ease. - Access to Top-Tier Providers:

Partnering with multiple leading insurance companies, MyFastBroker ensures you have access to the best options on the market. This gives you both competitive pricing and a wide range of coverage choices. - A Client-Centered Approach:

At MyFastBroker, it’s all about you. From personalized consultations to ongoing support, their team prioritizes your satisfaction every step of the way.

Why This Matters for You

Think about how much time you spend researching policies or trying to decode confusing terms. With MyFastBroker, you don’t have to go it alone. They simplify the process, saving you time and eliminating the stress of figuring it out on your own. Plus, their connections with top insurers mean you’ll likely save money while gaining better coverage.

Ready for a Better Experience?

Choosing MyFastBroker isn’t just about finding insurance; it’s about investing in peace of mind. From the moment you start working with them, you’ll see the difference in their personalized service and commitment to your satisfaction.

So why settle for less when you can have the best? Explore what MyFastBroker has to offer and experience the difference for yourself!

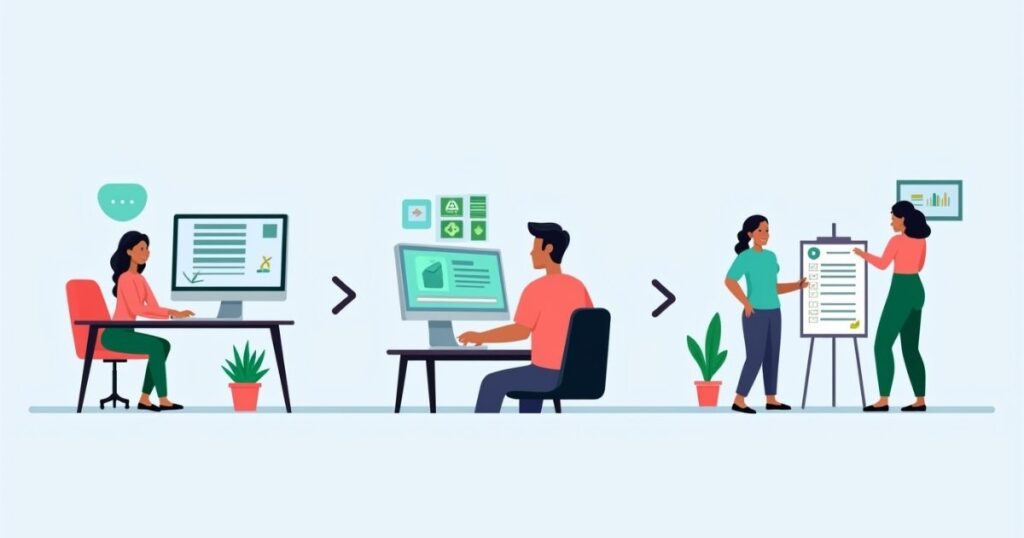

The MyFastBroker Process

Navigating the insurance landscape can feel like an uphill battle, but with MyFastBroker Insurance Brokers, the process becomes refreshingly straightforward. Curious about how they make it so simple? Let’s dive into their step-by-step approach that ensures you get the best coverage without the hassle.

1. Easy Onboarding and Consultation

From the moment you connect with MyFastBroker, you’ll notice how effortless everything feels. Here’s what happens during the initial phase:

- Simple Start: Begin by sharing your needs through a quick and user-friendly online form or a phone call with their team.

- Personalized Consultation: A dedicated broker listens to your concerns, asking the right questions to understand your unique situation.

- No-Pressure Approach: There’s no hard sell here—just honest, expert advice tailored to your priorities.

2. Finding the Perfect Policy

Once your needs are clear, MyFastBroker swings into action. Their process ensures you’re matched with the most suitable coverage:

- Extensive Research: They compare policies from a vast network of top insurance providers, ensuring you get the best options.

- Customized Recommendations: Instead of generic packages, you’ll receive a curated list of policies that align with your goals and budget.

- Clear Explanations: Unsure about deductibles or coverage limits? They explain everything in plain language so you can make informed choices.

3. Ongoing Support and Adjustments

MyFastBroker’s commitment doesn’t end once you’ve selected a policy. They provide continuous support to ensure your coverage evolves with your needs:

- Proactive Policy Reviews: Life changes—your insurance should too. They periodically review your policy to ensure it’s still the best fit.

- Claims Assistance: Filing a claim can be stressful, but MyFastBroker is there to guide you through every step, ensuring a smooth experience.

- Accessible Support: Have questions? Their team is always just a call or click away, ready to assist with any concerns.

Why This Process Works

It’s not just about efficiency—it’s about putting you at the center of the experience. MyFastBroker understands that insurance is personal, so they’ve designed their process to be as transparent, supportive, and tailored as possible.

Your Journey Starts Here

The MyFastBroker process is built to take the stress out of finding insurance and replace it with confidence. So, whether you’re looking for coverage for the first time or reevaluating your current policies, MyFastBroker is ready to help you every step of the way.

Ready to see how simple and rewarding insurance can be? Let MyFastBroker guide you to the coverage you deserve!

Types of Insurance Offered

Insurance isn’t a one-size-fits-all solution, and MyFastBroker Insurance Brokers understand that better than anyone. They’ve carefully curated a wide range of insurance options to cater to various needs, whether you’re protecting your personal assets, securing your business, or planning for the unexpected. So, what types of coverage can you explore with MyFastBroker? Let’s break it down.

1. Personal Insurance Solutions

Your life, home, and family deserve the best protection. MyFastBroker offers personalized policies designed to keep you covered:

- Homeowners Insurance: Safeguard your property against unexpected events like fires, theft, or natural disasters.

- Auto Insurance: From liability to comprehensive coverage, get a policy that matches how and where you drive.

- Health and Life Insurance: Ensure peace of mind with plans that support you and your loved ones when it matters most.

2. Business and Commercial Insurance Packages

Running a business is challenging enough without worrying about risks. MyFastBroker helps you secure your hard work with these tailored options:

- General Liability Insurance: Protect your business from claims related to accidents, injuries, or property damage.

- Professional Liability Insurance: Ideal for consultants and professionals, this coverage addresses claims of negligence or errors.

- Commercial Property Insurance: Keep your business assets safe from damage, theft, or unforeseen events.

3. Specialized Policies for Unique Needs

Sometimes, your needs go beyond the standard. That’s where MyFastBroker shines with their specialized offerings:

- Travel Insurance: Heading abroad? Protect your trip with coverage for cancellations, medical emergencies, and lost belongings.

- Cyber Insurance: In today’s digital world, businesses need protection against cyber threats and data breaches.

- Pet Insurance: Ensure your furry family members receive the care they deserve without breaking the bank.

Why a Broad Range of Options Matters

Having access to a variety of policies means you can find the exact coverage that fits your life or business. MyFastBroker doesn’t just hand you a generic list—they guide you to the solutions that make the most sense for your unique situation.

What’s Next?

The world of insurance is vast, but it doesn’t have to be overwhelming. With MyFastBroker by your side, you can confidently explore options and secure the coverage you need—all while knowing you’re getting the best value.

Which type of insurance are you looking for today? Let MyFastBroker simplify the process and connect you with policies tailored just for you!

Benefits of Using MyFastBroker

When it comes to managing your insurance needs, why should you choose MyFastBroker? The answer lies in the value they bring to the table. From saving you time and money to offering personalized service, the benefits of working with MyFastBroker go far beyond the surface. Let’s explore what sets them apart and why they’re the right choice for your insurance journey.

1. Cost Savings Through Expert Negotiations

Have you ever felt like you’re overpaying for insurance? With MyFastBroker, you can rest assured that won’t happen. Their brokers:

- Compare policies across multiple providers to find the most competitive rates.

- Leverage their industry expertise to negotiate better deals on your behalf.

- Help you identify unnecessary add-ons, ensuring you only pay for what you truly need.

2. Simplifying the Complex Insurance Landscape

Insurance policies are often filled with technical jargon that’s difficult to understand. MyFastBroker makes it easy by:

- Explaining coverage options in simple terms so you can make confident decisions.

- Providing clear comparisons between different policies to highlight the best fit for you.

- Answering your questions with patience and clarity, ensuring nothing is left to guesswork.

3. Access to a Wide Range of Insurance Providers

Why limit yourself to just one insurance company when you can access many? MyFastBroker:

- Works with a diverse network of trusted insurers, giving you more choices.

- Matches you with providers who specialize in your specific needs, whether it’s home, auto, or business coverage.

- Ensures you benefit from both competitive pricing and comprehensive coverage.

4. Time-Saving Convenience

Your time is valuable, and MyFastBroker respects that. They streamline the entire process by:

- Doing all the legwork for you, from research to policy comparisons.

- Managing renewals and adjustments, so you don’t have to worry about a thing.

- Handling claims support, ensuring a smooth and hassle-free experience.

5. Personalized and Ongoing Support

MyFastBroker doesn’t just help you find insurance—they build lasting relationships. Their team:

- Provides continuous support, offering policy reviews to ensure your coverage evolves with your needs.

- Stays available to answer your questions or assist with claims at any time.

- Delivers service with a personal touch, making you feel like more than just a number.

Why These Benefits Matter

In a world where insurance can feel like a maze, MyFastBroker acts as your guide, ensuring you don’t just find a policy—you find the right policy. By focusing on your needs, simplifying the process, and delivering exceptional value, they make insurance a stress-free experience.

Take the First Step

Ready to enjoy these benefits for yourself? With MyFastBroker, you’re not just getting an insurance policy—you’re gaining a partner who puts your best interests first. Let them save you time, money, and worry, so you can focus on what truly matters.

Explore the difference with MyFastBroker today and see how easy insurance can be!

How to Get Started with MyFastBroker

Getting started with MyFastBroker Insurance Brokers is a simple and seamless process designed with your convenience in mind. Whether you’re new to insurance or just looking to upgrade your current policies, MyFastBroker makes it easy to take that first step. Here’s how you can get started today.

1. Create Your Online Profile

Your journey begins with a quick setup:

- Visit the Website: Head over to the MyFastBroker site and explore their intuitive platform.

- Fill Out a Simple Form: Provide basic details about your insurance needs, such as the type of coverage you’re seeking and your budget.

- Secure Your Account: Rest assured that your information is safe, as MyFastBroker prioritizes security and privacy.

2. Schedule a Consultation

Once your profile is ready, the next step is a personalized consultation:

- One-on-One Guidance: A dedicated broker will reach out to discuss your needs and answer any initial questions.

- Tailored Solutions: During the consultation, you’ll receive recommendations based on your specific situation and goals.

- No Strings Attached: This step is obligation-free, ensuring you feel comfortable exploring your options.

3. Review and Compare Policies

MyFastBroker takes care of the heavy lifting by presenting you with the best options:

- Side-by-Side Comparisons: See how different policies stack up in terms of coverage, cost, and benefits.

- Expert Insights: Your broker will explain the pros and cons of each policy, helping you make an informed decision.

- Custom Adjustments: If needed, they’ll tweak the options to ensure every detail aligns with your needs.

4. Finalize Your Coverage

Once you’ve chosen the perfect policy, it’s time to wrap up:

- Paperwork Made Easy: MyFastBroker handles all the documentation, saving you time and effort.

- Seamless Activation: Your coverage will be activated promptly, giving you peace of mind without delay.

- Ongoing Support: After finalizing, you’ll have access to continuous support for adjustments, renewals, or questions.

Here are answers to some common concerns:

- How long does the process take? Most clients complete the setup and consultation within a day or two.

- Do I have to commit immediately? Absolutely not. You can take your time reviewing the options before making a decision.

- Can I switch providers through MyFastBroker? Yes, they’ll guide you through the transition with ease.

Why This Process Works

At MyFastBroker, the focus is on you. Their streamlined process combines cutting-edge technology with a personal touch, ensuring your experience is both efficient and comfortable. Whether it’s your first time getting insurance or you’re looking to switch providers, their team is there to make the journey smooth and stress-free.

Your Next Move

There’s no better time to take control of your insurance than today. With MyFastBroker, you’ll have expert support, tailored options, and a process that puts your needs first.

Why wait? Start your journey with MyFastBroker now and experience the difference of working with a broker who truly cares!

Conclusion

Choosing the right insurance doesn’t have to be overwhelming. With MyFastBroker Insurance Brokers by your side, the journey becomes simpler, smarter, and more tailored to your needs. Whether you’re protecting your family, your business, or your future, you deserve a partner who listens, understands, and delivers.

Think about it—how much time and money could you save with expert guidance? How much peace of mind would you gain knowing you’ve chosen the perfect coverage? At MyFastBroker, it’s not just about insurance; it’s about making sure you feel secure every step of the way.

So, why not take the first step today? Let MyFastBroker help you navigate the complex world of insurance with ease. From personalized consultations to ongoing support, they’re here to make sure you’re always covered.

Your perfect policy is just a click or call away. Explore the possibilities with MyFastBroker and discover the difference a dedicated insurance broker can make in your life. Don’t wait—start your journey toward smarter, stress-free insurance now!

FAQ

What does an insurance broker do?

An insurance broker helps clients find the best insurance policies by comparing multiple providers. They offer personalized advice and negotiate better rates, ensuring the coverage fits your needs and budget.

How is MyFastBroker different from other insurance brokers?

MyFastBroker stands out with its personalized service, access to top-tier providers, and ongoing support. They simplify the insurance process, making it stress-free and tailored to your unique situation.

Why should I use an insurance broker instead of going directly to an insurer?

Brokers provide access to a wider range of options, expert guidance, and help you avoid overpaying. They advocate for your best interests, unlike direct insurers who may push specific products.

What types of insurance can I get through MyFastBroker?

MyFastBroker offers various insurance options, including personal insurance (home, auto, health), business insurance, and specialized policies like travel or pet insurance.

How do I get started with MyFastBroker?

Starting with MyFastBroker is easy. You can create an online profile, schedule a consultation with an expert, and review tailored policy options before making a decision.

Can MyFastBroker help with claims?

Yes, MyFastBroker assists clients with filing claims, ensuring the process is smooth and efficient. They act as your advocate, making sure you receive fair compensation.

Does using a broker cost more than buying insurance directly?

No, brokers often save you money by finding better deals and avoiding unnecessary add-ons. Their fees, if any, are transparent and explained upfront.